Introduction

It’s critical to know the difference between debits and credits in accounting. This knowledge is especially important when it comes to understanding accounts payable (AP) since knowing whether AP transactions are debits or credits can have significant implications for your business's finances. This article will explore the question: are AP debits or credits? We will define debits and credits, explain the accounting theory of debits and credits, and provide some tips for recording accurate transactions with debit/credit entries.

Debit and credit defined

Debit is a financial term that refers to recording an amount owed or subtracted from an account balance. When a transaction is debited from an account, it means that the transaction amount reduces the account balance. In other words, the debiting of an account represents a reduction in the account balance.

Credit is a financial term that refers to recording an amount added or deposited to an account balance. When a transaction is credited to an account, it means that the transaction amount increases the account balance. In other words, the crediting of an account represents an addition to the account balance.

Debits and credits are commonly used in banking and accounting. Debits are used to record transactions such as purchases, withdrawals, and expenses. For example, when a person uses a debit card to purchase something, the transaction is recorded as a debit, and the amount of the purchase is deducted from the person's bank account.

Credits are used to record transactions such as deposits, payments, and income. For example, when a person receives a paycheck, the transaction is recorded as a credit, and the amount of the paycheck is added to the person's bank account.

In accounting, debits, and credits are used in the double-entry bookkeeping system to record transactions. Every transaction has two sides: a debit and a credit. Debits are used to record an increase in assets or expenses and a decrease in liabilities or equity. On the other hand, credits are used to record an increase in liabilities or equity and a decrease in assets or expenses. Understanding the concept of debits and credits is essential for anyone who wants to work in finance, accounting, or banking.

The accounting theory of debits and credits

The accounting theory of debits and credits is a fundamental principle of double-entry accounting. In double-entry accounting, every financial transaction is recorded in at least two accounts, with one account debited and the other account credited. This ensures that the books are balanced.

Debits and credits are used to record increases and decreases in account balances. Debits increase asset accounts and decrease liability and equity accounts, while credits do the opposite. For example, when a company purchases inventory on credit, the inventory account is debited (increased), and the accounts payable account is credited (increased). This transaction increases the company's assets (inventory) but also increases its liabilities (accounts payable).

The use of debits and credits can be confusing for those new to accounting, as they are not always intuitive. The key to understanding debits and credits is to remember that they represent opposite movements. For example, if a company pays cash to purchase equipment, the cash account is credited (decreased), and the equipment account is debited (increased). This transaction decreases the company's assets (cash) and increases its assets (equipment).

Are accounts payable a debit or a credit?

Accounts payable is a liability account, which represents the amount of money a company owes to its vendors or suppliers for goods or services purchased on credit. Since a liability account is recorded as a credit in accounting, accounts payable is a credit account.

When a company purchases goods or services on credit, the amount owed is recorded in the accounts payable account as a credit. This entry increases the amount of money the company owes its vendors, which is a liability. On the other hand, when the company makes a payment to the vendor, the amount is recorded as a debit to the accounts payable account, decreasing the liability. However, the account may be recorded as a credit if a company makes early payments or pays more than is owed.

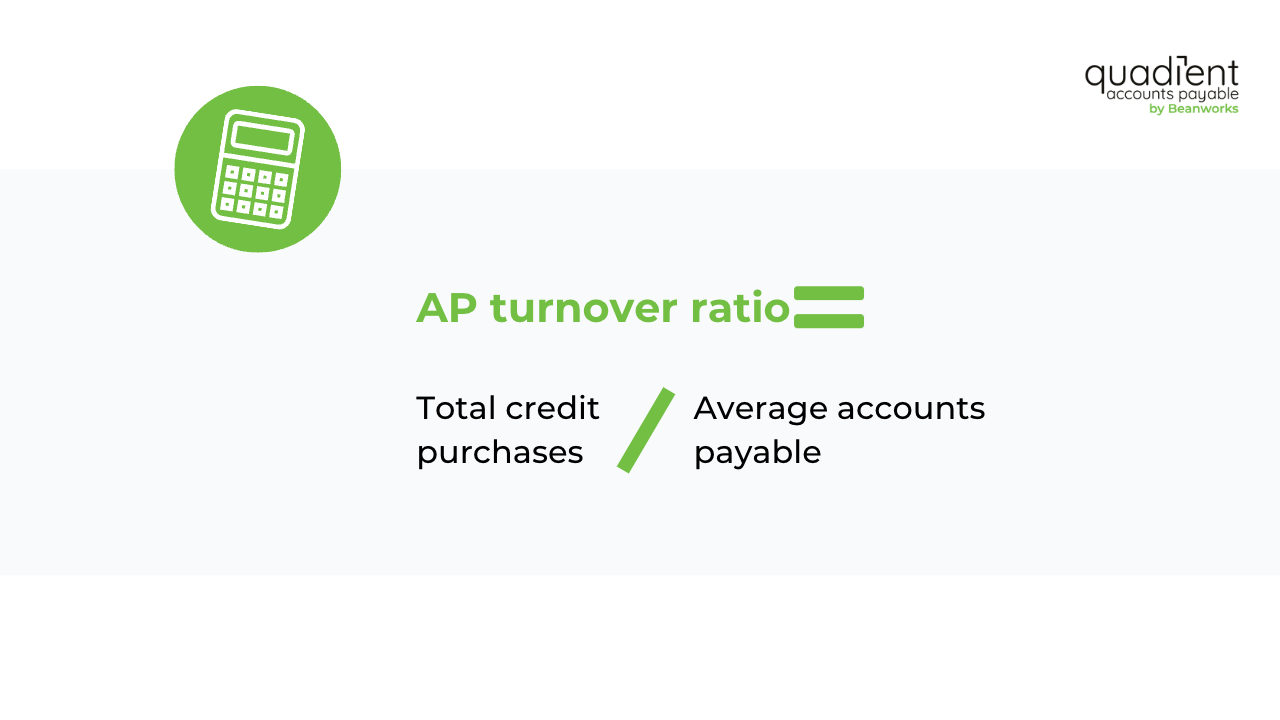

What is an AP “turnover ratio”?

The AP turnover ratio is a financial ratio that measures how quickly a company pays its suppliers and vendors. It is calculated by dividing the total amount of purchases made on credit during a specific period by the average accounts payable balance during that same period. The resulting ratio represents the number of times a company pays off its accounts payable balance in a given period.

A high accounts payable turnover ratio indicates that a company pays its suppliers promptly and efficiently. It can also indicate that a company is managing its cash flow effectively and using its working capital efficiently. While a low accounts payable turnover ratio can indicate that a company is having difficulty paying its bills or delaying payments to suppliers.

The accounts payable turnover ratio is an important measure of a company's financial health and its ability to manage its payment obligations to suppliers. Carefully monitoring this ratio helps companies identify areas where they need to improve their financial management and ensure they maintain good relationships with suppliers.

Journal entries for debits and credits

When your business accepts an invoice from a supplier, you must debit your purchase account by the value of the items purchased and credit your AP account for the same amount. For short-term debt, once you’ve paid the invoice, you will debit the balance in your AP account.

Credit example:

Your business purchases letterhead for £500. This is a short-term liability since you intend to pay the supplier within 30 days.

In a double-entry accounting system, the journal entries for this expense are recorded as follows:

- debit the relevant purchasing account

- credit your AP account for the same amount

Debit example:

When you are ready to pay the invoice for the letterhead in a double-entry accounting system, the journal entries for this expense are recorded as follows:

- debit your AP account

- credit another account for the same amount

Tips for recording accurate transactions with debit/credit entries

Recording accurate transactions with debit/credit entries is essential for any business, as it ensures that the financial records are up-to-date and accurate.

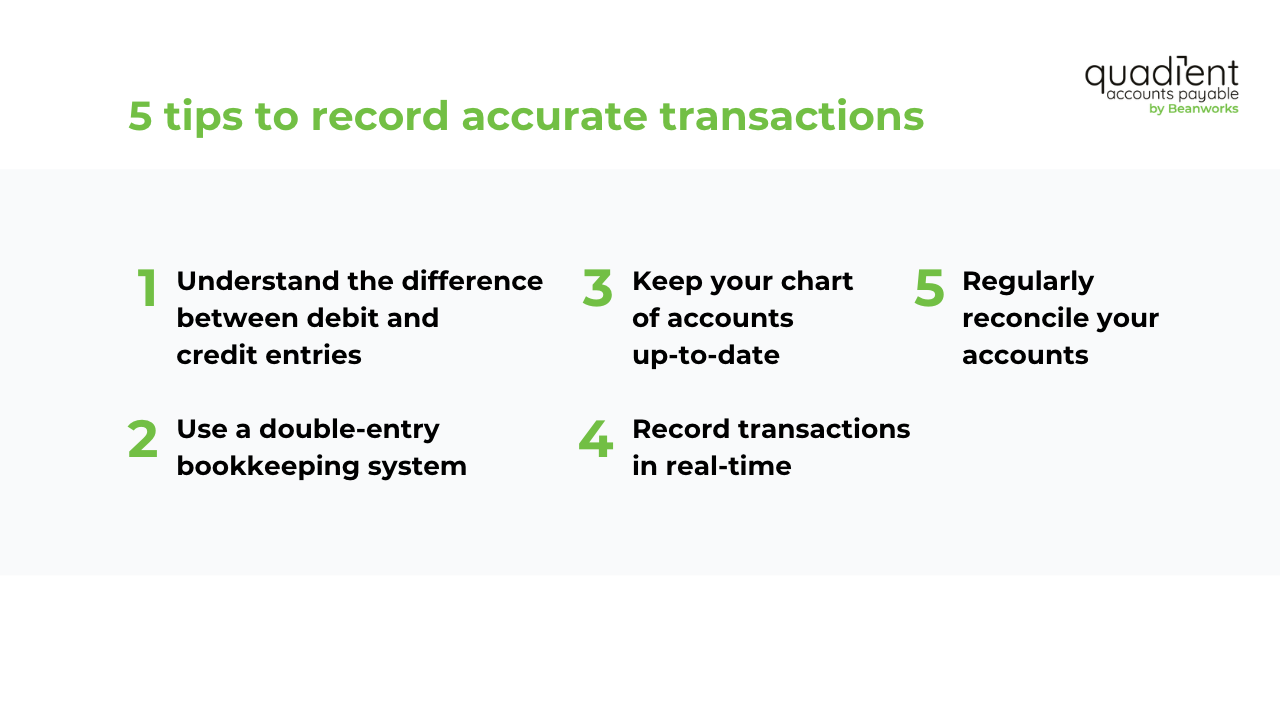

Here are some tips to help you record accurate transactions with debit/credit entries:

- Understand the difference between debit and credit entries: Debit and credit entries are the two sides of every transaction. Understanding the difference between them is essential for accurate record-keeping. In short, debit entries represent an increase in assets or a decrease in liabilities, while credit entries represent a decrease in assets or an increase in liabilities.

- Use a double-entry bookkeeping system: A double-entry bookkeeping system ensures that every transaction is recorded twice, once as a debit and once as a credit. This system ensures that your books are balanced and your financial statements are accurate.

- Keep your chart of accounts up-to-date: Your chart of accounts is a list of all the accounts you use to track your business finances. It's important to keep this list up-to-date and organized so that you can quickly and accurately record transactions.

- Record transactions in real-time: Recording transactions in real-time ensures that your records are accurate and up-to-date. It also makes it easier to track your cash flow and identify issues that need to be addressed.

- Regularly reconcile your accounts: Reconciling your accounts regularly ensures that your records are accurate and that there are no discrepancies between your records and your bank statements.

By following these tips, you can ensure that your business's financial records are current and accurate, which can help you make informed business decisions and ensure your business's long-term success.

Conclusion

As we’ve covered in this article, accounts payable is a credit in accounting, representing the amount of money a company owes to its suppliers for goods or services purchased on credit. In the double-entry booking system, debits and credits are used to record transactions, with every transaction having both a debit and a credit. Understanding the concept of debits and credits is critical for anyone who wants to work in finance, accounting, or banking. By accurately recording transactions with debit/credit entries, businesses can maintain their financial records and make informed decisions about their finances.