Key Takeaway: In 2025, financial automation has moved from nice-to-have to essential. CFOs who connect AP, AR and invoicing in a single, automated ecosystem get cleaner data, faster decisions and more resilient operations. Quadient’s financial automation solutions bring these pieces together so finance teams can spend less time fixing spreadsheets and more time steering the business.

Financial automation is no longer a nice-to-have, it’s the backbone of a future-ready finance function.

In 2025, forward-thinking CFOs are already using automation to prepare for the pressures that will shape finance in 2026 and beyond.

In our latest webinar, “The Future of Financial Automation,” experts Laura Elliston (Senior Manager of Product Marketing at Quadient) and Sarah-Jayne Martin (Senior Director of Global Financial Automation Solutions at Quadient) explored how finance leaders can harness automation to improve accuracy, boost efficiency, and make faster, data-driven decisions.

Why Financial Automation Is Business-Critical in 2026

Global uncertainty, inflation pressures, and talent shortages are forcing finance teams to rethink how they operate. Laura Elliston opened the session by highlighting that manual finance processes across credit-to-cash and purchase-to-pay (P2P) are now a competitive risk rather than a convenience - “Tight labor markets in many regions mean companies will continue to face pressure to increase productivity and do more with less,”.

The OECD projects global growth at just 2.9% by 2026, underlining why automation is essential for resilience and efficiency. Finance teams that digitize early are better equipped to adapt, forecast, and scale.

The Efficiency Imperative: Freeing Finance to Focus on Strategy

Automation isn’t just about speed, it’s about value creation. Laura shared that finance teams spend an average of six hours weekly on manual tasks, with 16% wasting more than ten hours. By automating repetitive workflows, teams can refocus on analytics, strategic planning, and stakeholder communication.

Sarah-Jayne Martin expanded on this, “Predictive analytics, powered by AI and machine learning, allows AP teams to optimize payments, while AR teams can identify patterns in customer behavior for better cash flow forecasting and risk management.”

Reducing Errors, Increasing Data Confidence

Manual work doesn’t just slow teams down, it introduces costly risk. Research cited in the session revealed that 33% of accountants admit to making multiple errors each week, while 89% of CFOs have made decisions based on inaccurate data.

Automation combats these issues through real-time data validation, centralized dashboards, and AI-driven anomaly detection. “Automation eliminates errors and enhances data analysis,” Laura emphasized. “With AI and machine learning, you can detect trends early and act decisively.”

Empowering Finance Teams and Enhancing Customer Experience

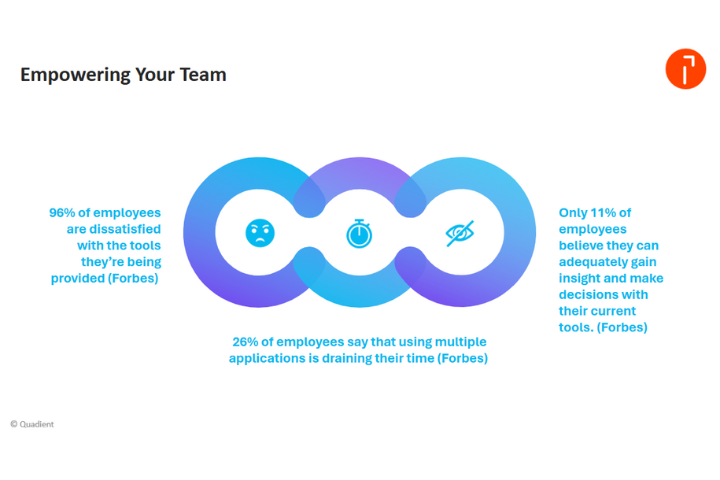

Efficiency also means better employee and customer experiences. Nearly 96% of employees say they’re unhappy with current tools, and a third feel that switching between multiple applications reduces their productivity. Automation streamlines workflows, reduces tool fatigue, and allows finance professionals to contribute strategically. Moreover, customers benefit, with faster response times, smoother invoicing, and transparent communication. “When finance operates seamlessly, customers notice,” noted Sarah-Jayne. “Automation enables better collaboration across the entire value chain.”

The Technologies Redefining Financial Automation

Looking ahead, three technologies are reshaping finance:

- AI & Predictive Analytics: Improve forecasting and decision accuracy.

- Blockchain: Enables transparency and traceability, Gartner predicts it’ll be indispensable for CFOs by 2025.

- Cloud Infrastructure: 94% of enterprises use it today, but only 44% of small businesses do, a gap ripe for transformation.

“Generative AI, predictive analytics, and chatbots are now essential tools for automation,” Sarah-Jayne said. “Cloud adoption is the glue that connects these technologies into a unified financial ecosystem.”

The Roadmap: How to Execute a Successful Digital Transformation

A clear strategy separates leaders from laggards. Sarah-Jayne outlined key success factors:

- Set measurable goals and KPIs.

- Partner with IT and procurement to identify scalable solutions.

- Build change management into your rollout plan.

- Continuously track performance post-implementation.

“Adopting a unified automation approach ensures financial processes work together efficiently, eliminating data silos and reducing legacy costs,” she added.

Conclusion: Automation as a Strategic Imperative

Financial automation is more than technology, it’s the foundation of a data-driven, resilient finance function.

By leveraging AI, blockchain, and cloud solutions, leaders can empower teams, enhance accuracy, and deliver stronger outcomes across every financial process.

Frequently Asked Questions

What is financial automation in 2025?

Financial automation in 2025 means using software to handle everyday finance work like invoicing, collections, approvals and reporting. Instead of teams rekeying data or chasing emails, tools take care of the repetitive steps so AP, AR and finance leaders can focus on cash flow, forecasting and strategy.

Why is financial automation so important for CFOs in 2025?

In 2025, CFOs are dealing with tight labour markets, inflation and slow global growth. Manual, credit-to-cash and purchase-to-pay processes slow everything down and can introduce errors into critical decisions. Automating these workflows gives CFOs cleaner data, faster reporting and more time to work on scenario planning, risk and growth.

Which finance processes can we automate with Quadient in 2025?

Quadient helps automate both sides of the house: accounts payable, accounts receivable and invoicing. That means one ecosystem to capture invoices, manage approvals and payments, and also handle collections, cash application and AR analytics. You get a clearer picture of working capital without stitching together multiple point tools.

How does financial automation reduce errors and improve data confidence?

Research highlighted in the webinar shows that a high share of accountants and CFOs are still making decisions based on inaccurate or incomplete data. Automation helps by validating data in real time, centralising dashboards and using AI to flag unusual patterns before they become problems. In 2025, that means fewer surprises in the board pack and more trust in the numbers.

What technologies matter most for financial automation in 2025?

The big three are AI and predictive analytics, blockchain and cloud. AI helps teams forecast, prioritise and spot risk. Blockchain supports traceability and transparency, and cloud makes it easier to connect AP, AR and invoicing across locations and systems. Together, these technologies let CFOs design a unified financial automation strategy instead of managing a collection of disconnected tools.

Why choose Quadient for financial automation in 2025?

Quadient brings AP automation, AR automation and intelligent customer communications together in one family of solutions. In 2025, that means you can streamline invoice workflows, collections and financial communications with a single, modern platform, backed by strong analytics and proven results like lower DSO, reduced data entry and higher productivity across finance teams.