Introduction

Maintaining an efficient and effective accounts receivable (AR) management system is imperative to a company's financial health in today's increasingly competitive business environment. The ability to manage invoices, process payments, and mitigate the risk of bad debt undeniably impacts an organization's bottom line. This article will explore twelve AR best practices to help your team excel at managing cash flow, promoting healthy customer relationships, and ensuring financial stability for your business.

The accounts receivable process explained

The process of accounts receivable involves the numerous steps a company goes through to document, oversee, and receive payment for products or services supplied to its clients on a credit basis.

The AR process begins with generating an invoice that clearly outlines the terms and conditions for payment. The business then sends the invoice to the customer and monitors the payment due date. The company may follow up with reminders or initiate collections procedures if payment is not received on time.

Once payment is received, it is recorded in the company's financial records, and the outstanding receivable balance is reduced accordingly. Effective management of the accounts receivable process is essential for a company's cash flow and overall financial health.

Featured Resource: Credit 2 Cash eBook

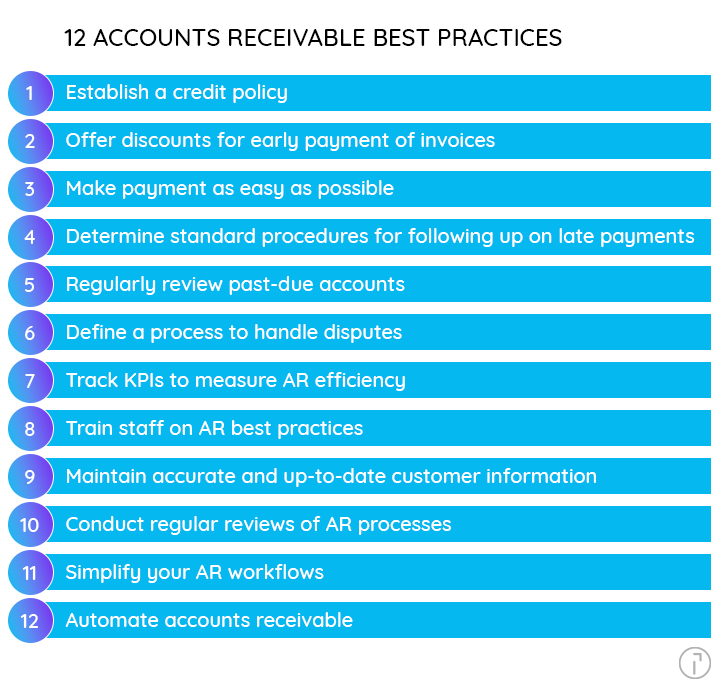

12 best practices for accounts receivable

1. Establish a credit policy

Most successful companies have well-defined credit policies that specify the types of customers eligible for net terms and those required to settle their accounts in full immediately.

By establishing a credit policy and ensuring your employees and customers are aware of it, you can decrease the chances of giving credit to customers who are unlikely to repay. If the policy is clear, employees won’t feel bad having to deny credit to certain customers — and customers who get denied won’t feel that they’re being unfairly treated.

2. Offer discounts for early payment of invoices

Consider offering your customers a discount if they pay invoices early. For example, you might add the terms “3/10 n/30” to your invoices to give customers who pay within ten days a 3% discount. Otherwise, the full amount of the invoice is due within 30 days.

You might not convince all your customers to take advantage of the early payment discount, but you will almost certainly convince some of them.

3. Make payment as easy as possible

Offer your customers multiple payment options. The more options you give them, the more likely they will pay their invoices on time. For example, instead of only accepting checks via mail, consider implementing an online payment portal that’s available 24/7. Accommodate as many payment options as reasonably possible.

The more convenient the payment process, the quicker you'll receive your payments.

4. Determine standard procedures for following up on late payments

Since it’s safe to assume that at least some of your customers won’t pay on time, your AR management policies should incorporate a comprehensive plan outlining how your accounting team should address late payments.

For instance, your policy could direct the AR team to email accounts with overdue payments one week after the due date and again the following week if no payment is received. If two emails do not yield a response, a team member should make a phone call to the account one month after the payment is due, informing them of the delinquency.

If these efforts do not result in the payment being received, it may be necessary to escalate the situation to an account manager or sales team member for further action.

5. Regularly review past-due accounts

To avoid being caught off guard by collections, your organization should regularly review late payments so that the AR management team and other executives stay updated on the status of receivables. Rather than being surprised by late payments, initiating a regular internal review, such as a monthly meeting, ensures everyone remains well-informed about the financial situation.

By consistently monitoring past-due accounts, stakeholders can be prepared for any fluctuations in cash flow and adjust strategies accordingly, allowing for better financial planning and minimizing unexpected late payment issues.

6. Define a process to handle disputes

Develop a defined process to handle customer disputes so that your AR professionals know exactly what to do when an issue is raised. This enables issues to be resolved faster, which helps increase customer satisfaction.

7. Track KPIs to measure AR efficiency

A simple way to continuously optimize accounts receivable management is by tracking key performance indicators (KPIs) with an ongoing focus on improvement.

Consider tracking AR performance metrics such as:

- Days sales outstanding (DSO): the average time it takes to collect payment.

- Average days delinquent (ADD): the average number of days customer payments are overdue.

- AR turnover ratio (ART ratio): the number of times customers pay invoices during a specific period.

- Collections effectiveness index (CEI): the percentage of accounts your business collects revenue on.

Gradually improving these indicators will result in a healthier cash flow situation for your business.

8. Train staff on AR best practices

All AR staff should be trained on accounts receivable best practices to ensure they understand the organization's policies and procedures. Training should include the process of handling disputes, collections procedures, and credit policies.

9. Maintain accurate and up-to-date customer information

Maintaining the accuracy of customer information is important to an effective accounts receivable process. Accurate address information, for example, is critical to ensuring that invoices aren’t sent to the wrong location, which results in late payments.

Organizations should maintain a central database of customer information and audit it on a regular basis to ensure that it’s accurate and complete.

10. Conduct regular reviews of AR processes

Conducting regular reviews of accounts receivable processes helps identify areas for improvement. Reviews can include analyzing invoices for errors, identifying bottlenecks in payment processing, and ensuring compliance with policies and procedures.

11. Simplify your AR workflows

AR management relies on workflows. The more complex your workflows are, the more room for error. Review your existing AR workflows to identify bottlenecks and identify opportunities for improvement. Optimal workflows should streamline decisions and focus efforts.

12. Automate accounts receivable

AR automation solutions give organizations real-time visibility into their cash inflows. Instead of spending hours searching for information, AR teams, sales teams, and executives can find the data they need in just a few clicks — whenever they want.

A smart AR platform connects your disparate systems - ERP, CRM, and billing software - and provides easy-to-read dashboards in one centralized platform. As a result, organizations can provide transparent communication between their finance and sales departments, giving all employees the data they need to do their best work.

For example, by integrating with QuickBooks ERP, businesses can further streamline their financial processes and ensure seamless synchronization of critical data, enhancing overall efficiency and productivity.

Click here to read our article about accounts receivable automation best practices.

Conclusion

Implementing some or all of these accounts receivable best practices is beneficial for businesses of all sizes. By establishing credit policies, making payments easy, and regularly monitoring past-due accounts, your organization can minimize late payments and improve cash flow. Tracking KPIs and adjusting strategies accordingly will help optimize receivable management, giving your business a stronger financial foundation. A strong receivables process will result in stable cash flow and an increased ability to make informed financial decisions for your organization's growth and success.