In this blog, you'll learn:

- What is the collection effectiveness index

- How to calculate the CEI

- Why measure CEI

- How to interpret CEI

- What's a good CEI

- CEI vs DSO

- How to improve CEI

What is the collection effectiveness index?

The collection effectiveness index (CEI) is used to measure the ability of the collections staff to collect funds from customers. This measurement shows how much was collected from the pool of all available accounts receivables, thus indicating if the collections team is achieving a high rate (over 80%) or if there is cause for further investigation into collections practices.

Featured Resource: The Ultimate AR Benchmarks Report

How to calculate the collection effectiveness index?

The CEI figure can be calculated for a period of any duration, and is typically done monthly. To calculate your CEI, you need a few numbers handy:

Beginning receivables is your open receivables at the start of the month. It also happens to be the ending total receivables from the previous month. For example, if your ending total receivables was $10 million on March 31, the beginning receivables for April 1 would also be $10 million.

Monthly credit sales is the sales made by extending credit in that month.

Ending total receivables is all of the open receivables including current and overdue receivables at the end of the month.

Ending current receivables are strictly the open receivables that are not overdue.

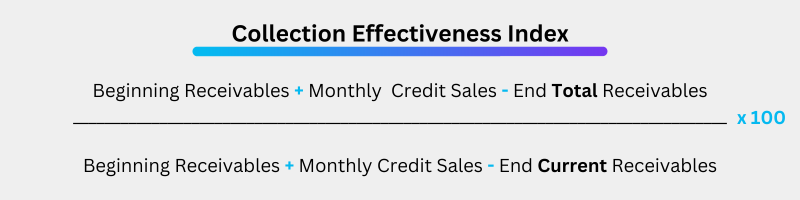

The formula for the CEI is:

(Beginning receivables + Monthly credit sales) - Ending total receivables

÷

(Beginning receivables + Monthly credit sales) - Ending current receivables)

x 100

So in real numbers, your calculation might look like:

Beginning receivables: $25M

Monthly credit sales: $40M

Ending total receivables: $35M

Ending current receivables: $20M

(25M + 30M) - 35M = $20M

(25M + 30M) - 20M = $35M

20M / M35 = .57

.57 x 100 = 57%

CEI = 57%

CEI Calculator (Scroll for Results)

Why measure CEI?

The result of your CEI calculation can give you actionable information. First, it shows your team's performance in collecting receivables. This indicates that your collections team has a process that's working to follow up on receivables and bring money into the business.

It also shows how quickly accounts receivables turn into closed accounts.

This window of time speaks to the strength of your collections process as well as to the health of your customers, who are able to address their bills in a timely fashion. Knowing how well your customers are responding to the actions of your collections team helps you keep on top of your forecasting, as well as your customer relationships.

Understanding this number and calculating it on a regular basis will also tell you when things change within your collections team or their procedures. An decrease in your CEI, for example, could indicate that a process is breaking down and requires improvement. Or conversely, the introduction of a new process could show benefits in closing open AR faster, and now you have a sense of the ROI for your new process.

How to interpret the collection effectiveness index?

As a metric, CEI helps you understand how well your collectors are performing. However, once you’ve determined your CEI, it helps to be able to interpret the figure. If the percentage is low, there may be several factors contributing.

- Incorrect or delayed invoicing – Forbes notes that 61% of late payments are due to invoice mistakes. Poor CEI can often be attributed to issues delivering invoices on time or sending them with inaccurate information.

- Poor credit policies – Being too generous with terms or failing to properly enforce existing credit policies can also cause a low CEI. It’s important to monitor things like customer credit scores, grades, and payment history and segment customers based on the results. Credit decisions should then be based on this data.

- Lack of payment options – Customers have different needs. If they are not able to make payments using their preferred method or currency — for those making cross-border payments—it may lead them to delay resolving an invoice.

- Lack of customer portfolio prioritization – While every invoice matters, they aren’t all equal. Your AR team should be prioritizing their collection strategy based on things like the risk of late payment and the amount due. Using predictive analytics to help determine risk levels can help with prioritization. It’s also important for teams to proactively approach accounts most at risk of late payment, rather than reactively approaching them after an invoice has already gone past due.

What is a good collection effectiveness index?

A good CEI indicates that your team is effectively managing accounts receivable and the collections process. In general, a CEI of 85% or higher can be considered good.

What about DSO?

Day Sales Outstanding (DSO) is another metric used to track the health and effectiveness of your cash flow. Some businesses use both DSO and CEI in tandem to get a fuller picture of their AR team's performance and their cash flow health.

DSO provides a snapshot into how long it takes your business to get paid, providing a sense of the health of your cash flow when tracked over time. This information tells you if you need to adjust credit or collections policies, or if the economy is having an impact on your working capital.

CEI looks specifically at the effectiveness of your collections department and tracking that your business is getting paid for its goods and/ or services. By regularly calculating CEI, you get a clear view into whether specific collections processes are working or require attention.

Finally, using both CEI and DSO will provide you with useful insights into your cash flow, helping you to manage your working capital in the most beneficial ways to ensure business growth.

How to improve collection effectiveness index?

Regularly monitoring CEI and attempting to determine the cause of a low CEI will help your organization determine what steps need to be taken to improve the metric. However, there are basic steps that every AR team can take to begin the process.

- Multiple payment formats – Adopt an AR solution that allows customers to quickly make payments on time using the method and currency of their choice.

- Adopt electronic workflows and escalations – Automating the collections process and using communications workflows helps ensure that invoices are delivered to the correct contact on time. Workflows should also be in place prioritizing high-risk accounts first.

- Invoice management – Integrate tech stack solutions like ERP and your AR software to minimize manual data entry and the risk of errors on invoices. Automate delivery of invoices so that they are sent out promptly.

- Increase data transparency – It's important that AR representatives and other members of the team have full access to customer data such as payment history, past communications, and contacts. This information will help with customer interactions, improve customer experience, and decrease the likelihood of late payments.

- Strong credit policies – Poor credit policies or a lack of a written credit policy can lead to late payments. A formal credit policy based on credit scores, payment history, and other relevant data ensures that each customer is offered the appropriate terms.

- Have a dunning process in place – Despite your best efforts, late payments will occasionally happen. It's important to have a comprehensive dunning process in place to reduce the likelihood of an invoice becoming severely delinquent.