Organizations that allow customers to make purchases with credit are essentially providing their clients with an interest-free loan. Accounts receivable is money owed without interest for a set term, typically providing the customer a 30, 60, or 90-day window to make payment.

Consistently monitoring the accounts receivable turnover ratio provides a clear understanding of your financial status, empowering you to detect the right moment for intervention to prevent a cash flow crisis.

In this article, you'll find:

- What is the ART Ratio

- How to Calculate the ART Ratio

- What is a Good ART Ratio

- Standard ART Ratio for Industry

- High vs. Low ART Ratio

- How to Improve ART Ratio

What Is Accounts Receivable Turnover Ratio?

The account receivables turnover ratio (ART ratio) is used to measure a company's effectiveness in collecting its receivables or money owed by clients. The ratio shows how well a company uses and manages the credit it extends to customers, and provides a number for how quickly that short-term debt is paid. This number can be calculated on a monthly, quarterly or annual basis.

Featured Resource: The Ultimate AR Benchmarks Report

How to calculate ART ratio?

To calculate the ART ratio, you need to choose what period of time you are measuring and know the beginning accounts receivables for the period, and the ending accounts receivables for the period. The formula looks like this:

Step 1: Determine your net credit sales (sales on credit - returns and sales allowance = net credit sales)

Step 2: Find your average accounts receivable (beginning accounts receivable + ending accounts receivable / 2 = average accounts receivable)

Step 3: Divide your net credit sales by your average accounts receivable (net credit sales / average accounts receivable = accounts receivable turnover)

Example:

The Smith Company has a beginning accounts receivable of $250,000 and an ending accounts receivable of $315,000.

- Their net credit sales is $3.8 million.

- $250,000 + $315,000 = $565,000 / 2 = $282,500

- $3,800,000 / $282,500 = 13.45

The Smith Company has an accounts receivable turnover of 13.45.

ART Ratio Calculator

What is a good ART ratio?

The ART ratio alone may not be meaningful, as every industry is different, and each business has its own terms for customer accounts. Therefore, it’s important to look at it in context of other information, which will help you assess how well the AR and collections process is working.

The first way to assess your ART ratio is to look at it in terms of other periods. If you calculate it monthly, how has the number adjusted month over month? If you calculate it quarterly, compare the past few quarters. You may be aware of certain spikes or changes in your business that impact the ART, and being able to account for that as you look at how the ratio shifts will give you an indication of whether or not your AR and collections process is performing well.

Another way to assess how your AR process is working is to look at competitors. For example, if investors were interested in the Smith Company, they might look at the Smith Company’s ART as it compares to their closest competitors. If the Jones Company has a higher ART ratio than the Smith Company, then the Jones Company might be a safer investment.

It is also useful to look at the actual number of days it takes to collect the receivables. This gives you the average for whether your customers are actually paying within the terms you’ve set. The formula is 365 days divided by the ART ratio. So for the Smith Company:

- 365 days per year/13.45 ART = 27 days

If the Smith Company has a 30-day payment policy, then their average number of days for payment falls within their policy window.

What is the standard ART ratio for my industry?

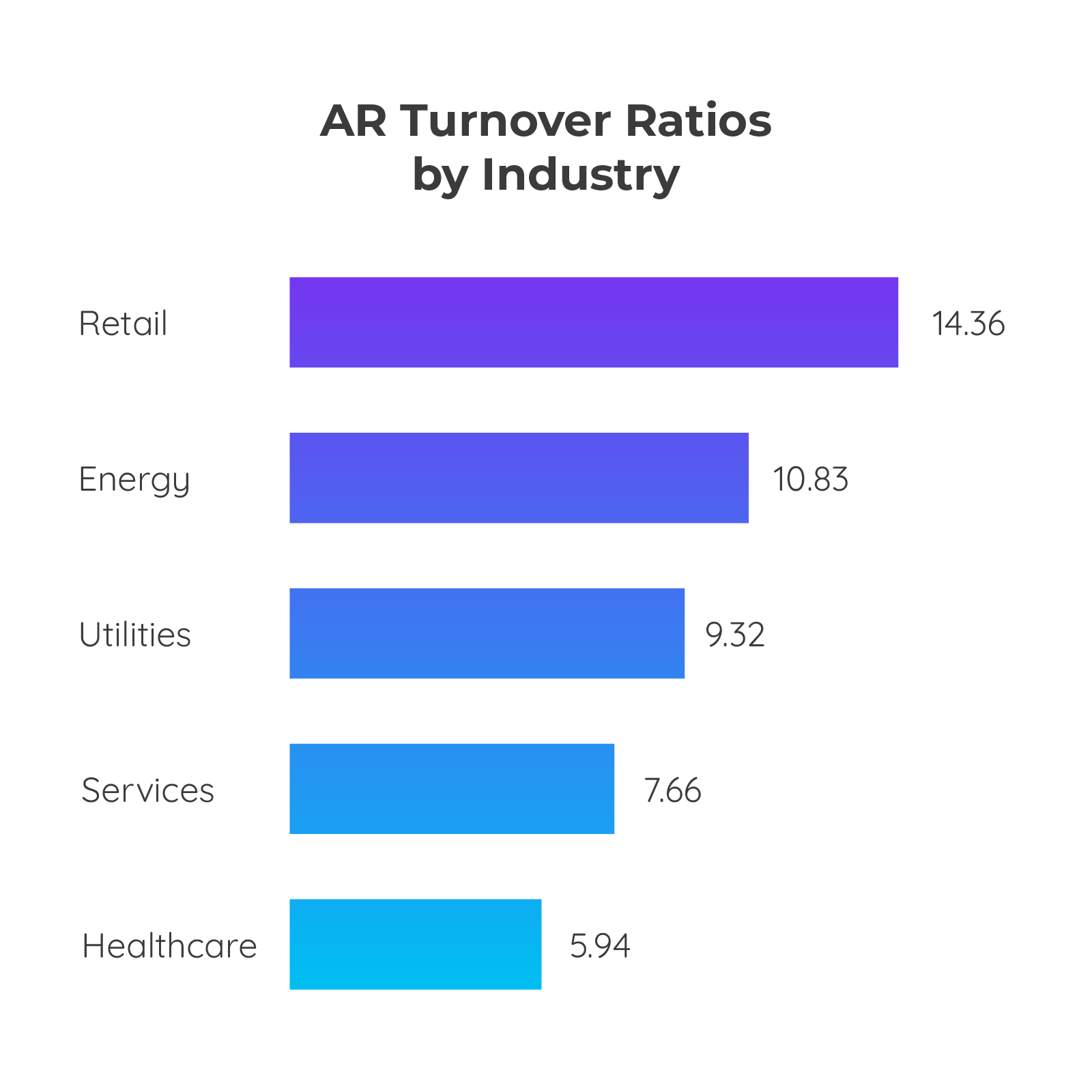

Because an optimal ART will be contingent on the industry, it helps to have an understanding of how your average competitor is faring. For instance, because manufacturing and construction typically have longer terms — 90 days — they will generally have a lower ratio.

Conversely, a retail establishment that often requires upfront payment, will generally have a higher ART.

CSIMarket, an independent digital financial media company, has released a report on accounts receivable turnover by industry as of Q2 in 2023. A look at some of the numbers provides a view of the spectrum that exists between sectors.

High vs. Low Ratios

A high receivables turnover ratio can indicate that a company’s collection of accounts receivable is efficient, and they have reliable customers who pay their debts quickly. A high receivables turnover ratio might also indicate that a company operates on a cash basis or has a conservative credit policy.

A low receivables turnover ratio can suggest the business has a poor collection process, bad credit policies, or customers that are not financially viable or creditworthy. Typically, a company with a low ART ratio should reassess its credit policies to ensure the timely collection of its receivables.

Keep in mind, there are some limitations with the ART ratio. One is to clarify if the calculation is being made with total sales instead of net sales. Using total sales inflates the results. Another limitation is that accounts receivables can vary dramatically throughout the year. For example, seasonal businesses will have periods with high receivables along with a low turnover ratio and then fewer receivables which can be more easily managed and collected.

Understanding the business cycles and processes is key to making smart use of the ART ratio. As a standalone metric it will not provide much value, but when you consider it within the overall context of the business, and the market, it can shed light on areas for improvement in our AR process, as well as highlight where your team is performing well.

How automation can improve your ART ratio

Inefficient receivables practices, particularly those related to manual AR, can increase the frequency of late payments and drive your ART up. The simplest and most practical way to improve your ART is to adopt automation software that streamlines the collections process.

- Automated Invoicing - Organizations should look for software that integrates with their ERP such as QuickBooks Online and allows for automated invoicing. This will eliminate the timely and error-prone practice of manual invoice creation. The software should also provide customers with a multitude of options relating to how they receive invoices, be it through email, customer portal, or even traditional paper mail.

- Follow Up Reminders – Customers are busy, and invoices can fall through the cracks as they focus on their day-to-day operations. An automation solution helps eliminate this problem by sending regular follow-up reminders after an invoice has been delivered. With customizable workflows, organizations can also build in escalations if emails remain unanswered or unopened.

- Improved dispute resolution – Disputes are another common speed bump in the collections process. Automation solutions that employ artificial intelligence streamline dispute resolution by scanning and assessing the dispute, and then directing it to the appropriate team member.

Understanding accounts receivable turnover ratio, and having context for how it compares to the industry average is a key to your AR performance. Automating the AR process provides you with the tools you need to optimize the process.