Introduction

Accounts receivable (AR) is a critical component of a healthy financial ecosystem for businesses worldwide. A well-managed accounts receivable department provides several benefits to a business, such as improved cash flow, reduced bad debts, enhanced supplier relationships, and more efficient operations. In this article we will define accounts receivable, explore its role in managing cash flow and customer relationships, and highlight how it impacts a company's overall financial health

What does accounts receivable mean?

Accounts receivable refers to the outstanding invoices or money owed to a company by its customers for goods and/or services provided on credit. In simple terms, it is the amount clients owe a business for products or services delivered but not yet paid for. AR is also the name of the function responsible for collecting payments owed to the company by its customers. Unpaid invoices are tracked by the AR team to ensure timely payments.

Now that we know what accounts receivable is, let's explore what type of account it is and where it fits on a company's balance sheet.

What type of account is Accounts Receivable?

Accounts receivable is classified as an asset on the company's balance sheet. Specifically, it is considered a current asset because it represents money owed to the business that is expected to be paid within a short period, typically within a year. This makes it a vital part of a company's liquidity, contributing directly to cash flow and financial health. Unlike long-term assets like property or equipment, accounts receivable are liquid and can be converted into cash relatively quickly once payments are collected.

Accounts Receivable on the balance sheet

By understanding its classification, we can now examine how accounts receivable influences the financial health of a business.

On the balance sheet, accounts receivable is a key indicator of financial health. It shows the value of unpaid invoices and reflects how efficiently a business collects payments. A well-managed AR helps maintain liquidity, while overdue AR balances can highlight cash flow issues.

By tracking AR, businesses ensure timely payments, contributing to a stable balance sheet and stronger financial standing.

When is Accounts Receivable revenue?

Although accounts receivable plays a key role in a company's financial structure, it's important to understand when it actually translates into revenue.

Though accounts receivable represent sales a company has made, the money owed is not considered revenue until it has been collected. AR is listed as an asset on the balance sheet, and only after the customer makes a payment is it recognized as actual revenue in financial reporting. Understanding this distinction is crucial because a high AR balance does not always translate to immediate cash flow or profitability. Efficient AR management ensures that what is considered potential revenue is eventually turned into actual revenue.

Why is accounts receivable important?

Given its role in cash flow and financial stability, let’s explore why accounts receivable is so critical for business success.

Accounts receivable is essential to the success of a business, no matter its size. This crucial aspect of financial management can make or break a business.

Here are a few reasons why AR is important:

- Positive cash flow - Ensuring enough money flows into your business is essential for growth and stability. When receivables are efficiently managed, businesses can provide for their ongoing operational needs, pay off debts, invest in growth, and ultimately, generate profits. Additionally, accounts receivable contributes to the strength of a company's balance sheet, showcasing its ability to collect payments from customers.

- Healthy business relationships - When customers consistently pay their invoices on time, it's a sign of a fruitful partnership. It's about fostering that trust and being able to rely on honoring agreements.

- Liquidity - Efficient AR management improves your business's liquidity, which in turn helps secure loans and funding. Financial institutions typically closely examine a company's accounts receivable when determining its creditworthiness.

- Predictable revenues - The less time and energy a business spends worrying about collecting payments, the more mental space it has for growth, innovation, and other business operations. A streamlined accounts receivable process enables predictable cash flow and enhanced financial planning.

To manage these vital functions, companies rely on a dedicated accounts receivable department.

Accounts Receivable department

The importance of AR management becomes clearer when we consider the department responsible for overseeing these processes.

The accounts receivable department plays a crucial role in managing the company's cash flow and ensuring timely collection of payments. This team is responsible for issuing invoices, tracking outstanding payments, and maintaining relationships with customers to facilitate smooth transactions. Additionally, the AR department handles disputes, monitors aging reports to identify overdue invoices, and initiates collection efforts when necessary.

How does AR work?

Now that we know what the AR department does, let’s take a closer look at the step-by-step process involved in accounts receivable.

The AR process begins after a customer places an order for goods or services that your business provides. Typically, the customer will send you a purchase order (PO), which details the goods/services ordered, the quantity, and the agreed price of the items.

Once the PO has been approved, a sales order (SO) is created. A sales order is a binding commercial document that includes the order details and confirms the sale. SOs also typically include the expected delivery date, delivery address, and payment terms.

Prior to sending the SO to the customer, your credit department will review it to determine whether credit terms can be established for the customer. Credit terms are the conditions under which a company extends its products or services to a client on credit. Once credit is extended, the sale is recorded, with the client as the debtor and the company as the creditor or lender.

The next step in the process is for the AR team to issue an invoice to the customer. The invoice details the goods or services ordered, the amount due, and the payment terms. Payment terms specify the period within which the customer is expected to pay, commonly set as a net 30, 45, or 60 days from the invoice date. Businesses often require a deposit upfront for large purchases or if the item is produced to order. Companies delivering services typically bill for some portion of their fees in advance.

The AR team then manages the collections process to ensure prompt payment from the customer. If a customer's payment is past due, collection efforts are initiated by the company, typically through friendly reminders via email, phone, or letter, based on the established credit terms. In some cases, businesses may charge late fees on unpaid invoices as an incentive for customers to pay on time. Late fees can vary based on company policy and the payment terms set in the initial contract. In the case of significantly overdue unpaid invoices, more aggressive collection tactics might be employed, including the use of collection agencies or taking legal action. If collection efforts fail, you must write off the receivable as bad debt.

AR teams are also responsible for addressing any disputes relating to invoices. Invoice disputes are any issue that prevents the payment of part or all of an invoice, and they are an inevitable part of the AR process. Common customer disputes include:

- Pricing: a difference in pricing between the agreed amount and the final charge

- Quality: the quality of a product or service billed on an invoice is in question

- Administrative: documents related to the purchase are missing or incorrect

- Payment terms: pricing terms, such as due dates, are in dispute

Once payment is received, the AR team records it in their accounting system. The transaction is recorded in the receivable ledger as a credit, and the amount is deducted from your remaining unpaid receivables balance. These transactions are typically tracked and reported at the end of each accounting period, which could be monthly, quarterly, or annually, depending on the company's financial reporting schedule. This process not only affects cash flow but also impacts the company's balance sheet by reducing the outstanding receivables and improving liquidity.

Accounts receivable examples

To better understand how accounts receivable functions in various business scenarios, here are a few examples:

- Retail company: A clothing retailer sells a bulk order of merchandise to a small boutique on credit. The retailer issues an invoice with a payment term of 30 days, during which the boutique is expected to pay for the goods received. Until the invoice is paid, the amount owed remains in the retailer's accounts receivable.

- Service-based business: A marketing agency provides monthly services to its clients, such as managing social media accounts. At the end of each month, the agency invoices its clients with a net 15-day payment term. The fees remain as accounts receivable until the clients fulfill their payment obligation.

- Manufacturing company: A manufacturer supplies raw materials to a factory, agreeing to payment terms of net 60 days. This means the factory has 60 days from the invoice date to pay for the materials received. The unpaid amount remains in the manufacturer’s accounts receivable until payment is made.

These examples highlight how accounts receivable can vary across industries but remain a key aspect of managing business cash flow and ensuring timely payments.

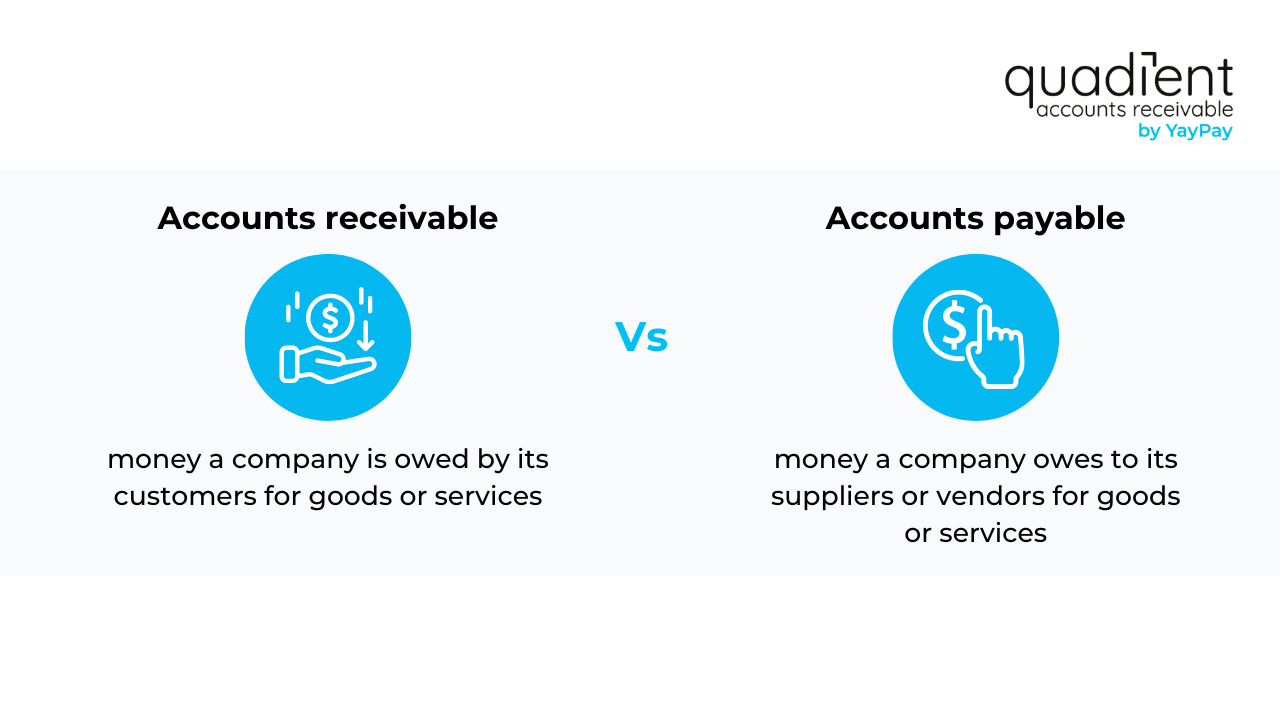

What is accounts receivable vs. payable?

Understanding the differences between accounts receivable and accounts payable (AP) is crucial for managing a company's financial health. The direction of the cash flow is the primary difference between accounts payable and accounts receivable.

Accounts receivable represents the amount of money a company is owed by its customers for goods or services it has provided on credit. This means the company has delivered the products or services but has yet to receive payment. As a company generates sales, its accounts receivable balance will increase, indicating that it has outstanding bills that it expects to collect from its customers in the near future. Timely management of accounts receivable is critical for maintaining cash flow and ensuring a steady income stream.

On the other hand, accounts payable refers to the money a company owes to its suppliers or vendors for goods or services it has received but has not yet paid for. Accounts payable typically result from purchases made on credit, wherein a company acquires products or services to fulfill its operational needs, with the agreement to pay for them at a later date. Managing accounts payable effectively is also vital for a business, as timely payments to vendors help maintain strong relationships with suppliers and avoid late payment penalties or damage to a company's creditworthiness.

AP and AR are crucial for a company's financial health. By prioritizing both, businesses can improve their operational efficiency and foster long-term success.

How does accounts receivable fit into the overall financial picture of a company?

Finally, let’s examine how AR integrates with other financial metrics to offer a complete view of a company’s financial health.

A healthy accounts receivable speaks volumes about the overall financial health of a business. Tracking accounts receivable is crucial for maintaining accurate financial records and cash flow projections. All AR transactions flow into the company’s general ledger, which is used to generate key financial statements like the balance sheet and income statement. Maintaining a well-organized general ledger helps businesses monitor their overall financial health and ensures compliance with accounting standards.

Companies that struggle to collect their accounts receivables in a timely manner may face serious cash flow problems, ultimately affecting their ability to support daily operations. In fact, one study found that 82% of companies that were forced to close their doors attributed their downfall to cash shortages.

Businesses can implement various strategies to ensure the timely collection of outstanding receivables, including invoicing, offering early payment discounts, and closely monitoring aging reports to identify potential collection issues.

Tracking the days sales outstanding (DSO) provides insights into how healthy a business’s cash flow is. DSO is the average number of days it takes a company to collect payment after a sale has been made. The longer a company must wait for payment for services rendered or products delivered, the less cash the business will have to cover expenses or fund growth.

Trends in DSO are very important because they can indicate if there is a cash flow/payment problem or if DSO is within standard variation or fluctuation. DSO is typically reported and evaluated monthly, quarterly, and annually. It’s important to understand DSO trends over a 12-month period because your numbers may vary month to month due to natural business cycles or the seasonality of your business.

Download our whitepaper, Top 7 Features Every Automated AR Solution Should Have, to learn more about choosing the ideal solution to reduce DSO and to have the biggest impact on your business.

Conclusion

Accounts receivable is an essential component of a company's financial management, impacting everything from cash flow and liquidity to customer relationships. Understanding the process of accounts receivable, from issuing invoices to collecting payment, is essential for effective cash flow management. By properly managing accounts receivable, companies can ensure they receive the funds needed to support operational expenses, capital investment, and growth. Therefore, accounts receivable is not just a financial metric but a key indicator of a company's financial health and overall success.