Introduction

Accounts payable (AP) is critical to an organization’s financial management. By implementing AP best practices, businesses can benefit from streamlined payment operations, reduce human error and fraud, and enhance cash flow management. This article will discuss the top 12 accounts payable best practices organizations should implement to boost the bottom line.

Demystifying the accounts payable process

The AP process is in charge of ensuring that payments are accurate, on time, and fraud-free.

When an AP department receives an invoice, the data on the invoice must be captured and accurately coded with account and cost center information. Next, AP team members perform a 2 or 3-way match by comparing the invoice to its purchase order and confirming that the goods or services were delivered. Finally, the invoice is sent to the designated individual(s) for approval and payment.

Accounts payable departments are also responsible for maintaining relationships with vendors, handling exceptions, identifying fraudulent and duplicate invoices, responding to vendor inquiries, and following up on approvals (which can take up to 20% of an AP professional's time!).

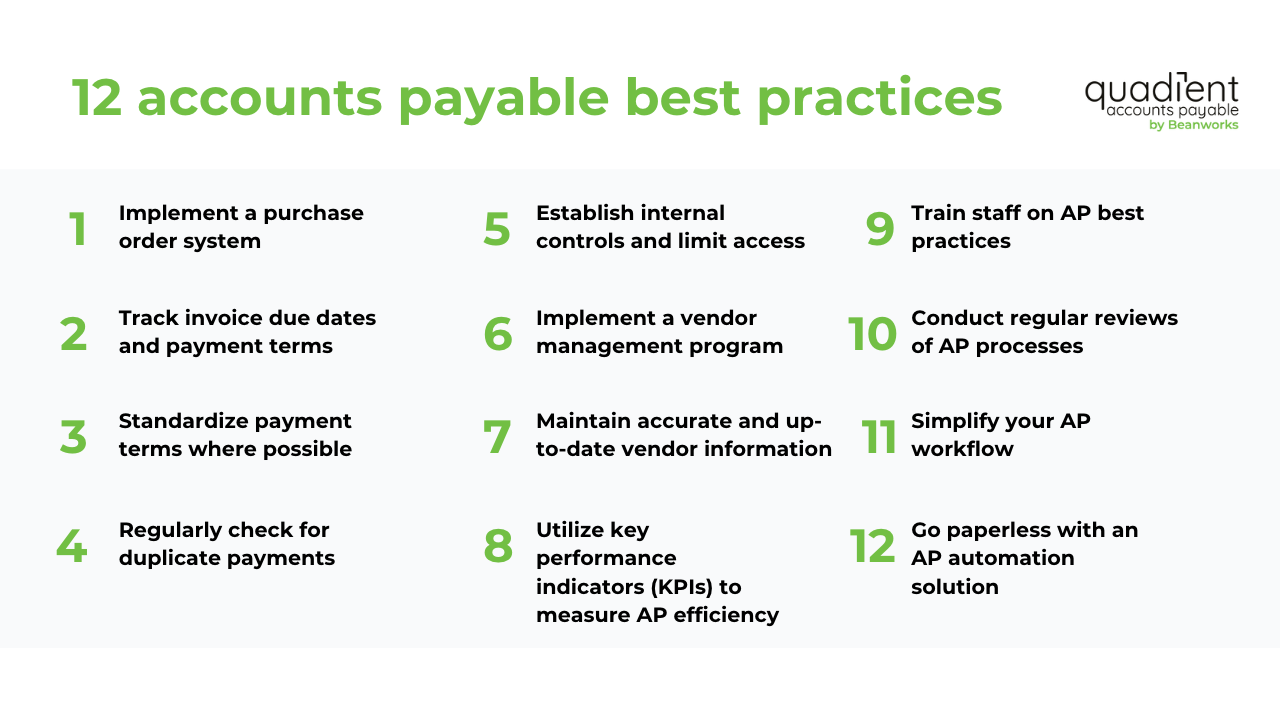

12 best practices in the accounts payable process

1. Implement a purchase order system

One of the best ways to control accounts payable is to implement a purchase order (PO) system. A purchase order system helps organizations manage and control their purchase orders and procurement process.

Purchase orders are legally binding agreements that a business’s purchasing department issues when placing an order with a vendor or supplier. A PO typically includes:

- A unique number for tracking the purchase order throughout the process

- A description of the item(s) and/or service(s) being ordered

- The quantity of items requested

- The cost of the item(s)

- Payment terms

A PO system ensures that purchases are authorized before ordering goods or services. A defined PO process creates efficiency and minimizes errors.

2. Track invoice due dates and payment terms

Accounts payable invoice processing best practices include tracking invoice due dates and terms. To manage cash flow and prevent late payments, which can harm supplier relationships, it is crucial to keep track of what must be paid and when. Careful tracking ensures on-time payments and provides the opportunity to take advantage of early payment discounts. To better manage your cash flow, prioritize invoices such that they are paid on time but not earlier than they are due if there are discounts.

3. Standardize payment terms where possible

Standardizing payment terms with suppliers is beneficial, particularly when working with a large number of suppliers. Establishing standard payment terms optimizes payment processing and gives you better cash flow control. Additionally, it eliminates the need for negotiations with individual suppliers, which can impact your DPO (days payable outstanding).

4. Regularly check for duplicate payments

If you are managing your AP manually, you should regularly check for duplicate payments to keep your cash flow in check. To ensure that invoices are received, suppliers may send a hard copy by mail and a soft copy by email. An AP team member may inadvertently submit both invoices for payment.

Automating your accounts payable process is one of the easiest ways to eliminate duplicate payments. Your system should automatically identify duplicate invoices and stop payment.

5. Establish internal controls and limit access

Establishing internal controls and limiting access is crucial in preventing fraud and errors in accounts payable. The controls can include the following:

- Separation of duties so that AP tasks are not handled by a single employee

- Limit access so that only specific people have access to the master vendor file

- Dual approvals require that two separate people authorize every transaction

- Regular audits to ensure the completeness, validity, and compliance of records

6. Implement a vendor management program

A defined vendor management program enables AP departments to manage vendor relationships more effectively. The program should include criteria for selecting vendors, evaluating vendor performance via regular audits, and managing vendor contracts.

Conducting vendor audits is essential for ensuring that vendors are complying with your organization's payment policies. Audits help identify discrepancies in invoicing or payment processes and allow organizations to address them promptly.

7. Maintain accurate and up-to-date vendor information

Keeping vendor information accurate and up-to-date is critical in preventing payment errors and fraud. Organizations should maintain a central database of vendor information and update it regularly.

8. Utilize key performance indicators (KPIs) to measure AP efficiency

Monitoring and analyzing accounts payable metrics can provide valuable insights into the organization's financial health. KPIs such as invoice processing time, cost to process a single invoice, and the invoice exception rate can help identify areas for improvement.

9. Train staff on AP best practices

All AP staff should be trained on accounts payable best practices to ensure they understand the organization's payment policies and procedures. Training should include the importance of internal controls, fraud prevention, vendor management, and dispute resolution.

10. Conduct regular reviews of AP processes

Conducting regular reviews of accounts payable processes helps identify areas for improvement. Reviews can include analyzing invoices for errors, identifying bottlenecks in payment processing, and ensuring compliance with payment policies and procedures.

11. Simplify your AP workflow

The more complex your workflow, the more opportunity for errors and late payment of invoices. Review your existing AP workflows to identify bottlenecks in the approval process. Centralize and standardize processes and reporting across the organization to further streamline the approval process.

12. Go paperless with an AP automation solution

AP automation solutions enable companies to submit invoices, manage approvals, and process payments electronically through a single platform. With AP automation software, businesses can eliminate manual processes, reduces costs, and mitigate the risk of errors and fraud. AP automation can integrate with your existing accounting platforms such as Netsuite, Sage, or Quickbooks. AP automation is commonly used to accomplish the following goals:

- Eliminate manual data entry

- Speed the approval process

- Generate digital audit trails

- Match invoices to POs and payments

- Enable secure, end-to-end payments

- Reduce errors related to duplicate invoices

Conclusion

Implementing these best practices for accounts payable can greatly benefit an organization in terms of efficiency, accuracy, and cost savings. By adopting these practices, companies can improve their relationships with vendors, ensure they pay their bills on time, and comply with regulations. Ultimately, a well-managed accounts payable function can contribute to an organization's overall financial health and success.