Some organizations believe that AP automation is limited to scanning invoices into digital formats. For others, it's simply a means digitizing employee expense workflows. But these are only two of the many functions available.

True AP automation includes four key features:

- Accounting software integration

- Automated data entry

- Workflow approvals

- Automated payments

Automated payments are where virtual credit cards (VCCs) come in. In this blog post, we'll define and discuss virtual credit cards, explain their advantages, and outline how your organization can benefit from them.

Free Download: How to track, benchmark, and improve your Accounts Payable KPIs

Download Your Free eBook

What is a virtual credit card?

A virtual credit card (VCC) is a randomly generated number associated with a physical credit card. Vendors can process a VCC the same way they would process a standard credit card, but without the physical card.

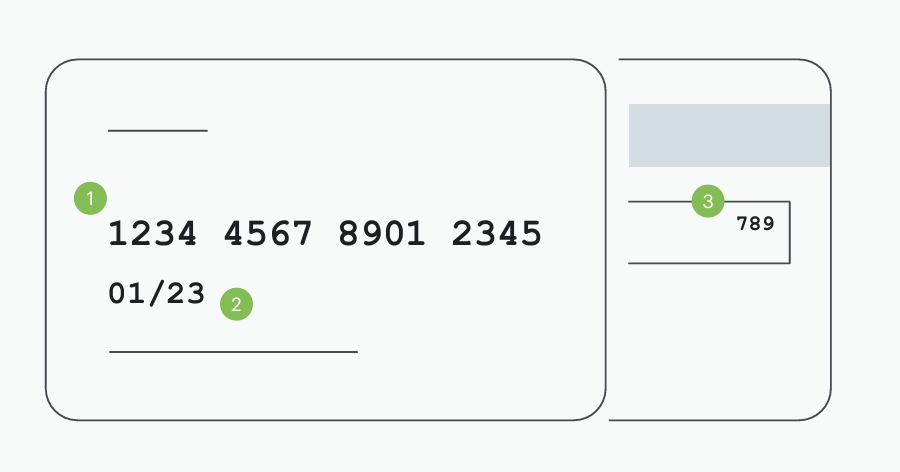

Just like physical credit cards, a virtual credit card has three components.

1 - Credit card number: The card number has 16 digits, just like a standard physical Visa or Mastercard credit card.

2 - Date of expiration: Virtual credit cards often expire much sooner than physical credit cards. These shorter dates prevent funds from being compromised for long periods of time should fraudulent transactions take place.

3 - Security code: All virtual credit cards have a Card Security Code (CSC), also called a Card Verification Code (CVC) or Card Verification Value (CVV/CVV2). This is to establish card ownership and authorize transactions.

What are the benefits of a virtual credit card?

VCCs offer a host of benefits to organizations, both large and small, that can be divided into three main categories:

- Fraud mitigation

- Accounting workflow integration

- Cash-back rebate opportunities

Fraud mitigation

Virtual credit cards are one of the most secure ways to pay vendors, thanks to the following features:

- Unique single-use card numbers: These VCCs are no longer valid once a transaction is complete. This eliminates the risk of stolen card numbers or checks going missing.

- Minimum and maximum credit amounts: VCCs can have limits associated with each transaction which are only valid for a predetermined amount of time.

- Limited issuance to primary cardholders: VCCs can be limited to the primary cardholder, eliminating the risk of fraud through secondary card holders.

Accounting workflow integration

Virtual credit cards allow for full integration with accounting workflows, meaning that payments can be approved and released to vendors directly from AP automation software. This leads to lower processing costs, improved efficiency, and more robust internal controls.

Cash-back rebate opportunities

VCCs also offer something that most typical corporate payment types cannot: cash-back rebates. VCC users are eligible for monthly cash-back rewards based on their spending, just like many standard physical credit cards.

This simple and effective way to generate new revenue just by paying bills, while helping to offset the costs of AP automation, can earn a business cash back on a monthly basis.

How to get a VCC for your business

The process of getting a virtual credit card can differ depending on the provider, but it is fairly simple. Here are the most common ways to get a VCC:

- Bank: You can get a new card number for every transaction, or a separate number for each vendor which stays the same over time. Banks offering VCC services include Mastercard, Visa, and American Express.

- AP software: With an AP automation solution like Quadient AP, the software will automatically create a unique VCC number for every transaction.

Get even more value with VCCs and Quadient AP's automation solution

Companies of all sizes will get peace of mind from the security and efficiency of virtual credit cards. If you're looking for a more detailed guide, check out our white paper Getting started with virtual credit cards .

When you're ready, book a demo with us to see how Quadient AP can help you deliver a virtual credit card solution for your organization.